Response To Notices

We as a solution provider for all GST related queries, help you to answer all notices and help you in paying proper penalties. Also will guide you to pay on time so that you can avoid following penalties of Non-Compliances.

Penalties of Non-Compliance

- All GST Returns must be filed by the 20th of the following month. There are strict laws under the GST Act for non-compliance with the Rules & Regulations.

- Penalty for Not Getting GST Registration, when a business is coming under the purview. The penalty is 100% of the tax amount if the offender has not filed for GST registration and intends to purposefully avoid. The amount is the tax as applicable. Or Rs. 10,000, whichever is higher.

- A penalty of 100% tax due or Rs. 10,000, whichever is higher, is also applicable to those who choose Composition Scheme despite not being eligible to it.

- Any offender not paying his due tax or making short payments (genuine errors) is liable to pay a penalty of 10% of the tax amount. This amount cannot be less than Rs 10,000.

- A person guilty of not providing the GST invoice is liable to be charged 100% tax due or Rs. 10,000. Whichever is higher

- An offender will be charged a fine of Rs. 25,000 for incorrect invoicing.

- If a person has not filed for unpaid tax, there is a penalty of Rs. 50 per day. Rs. 20 per day if he was to file for NIL returns. And the maximum amount must not exceed Rs. 5,000.

- There is also a provision of the penalty by a jail term for tax offenders to commit fraud.

GSTIN

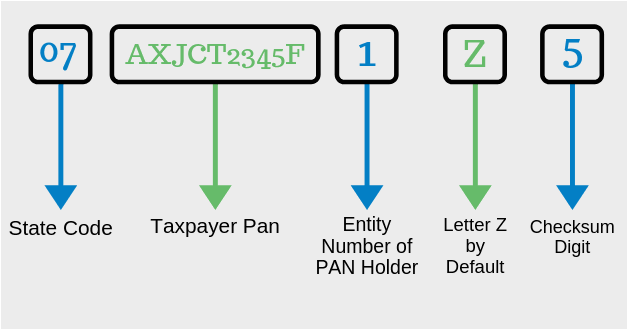

- GSTIN is a unique 15-digit alphanumeric code that is allotted to each Firm/Company/Individual, who are registered under GST.

- The government has ensured that everything under GST is digital so that there is maximum transparency with minimum corruption.

- The first 2 digits of the GSTIN represent the state code which is given as per the 2011 census.

- The next 10 digits are the PAN number of the entity.

- The 14th digit is Z by default.

- The 15th or the last digit is the Checksum digit. It comes, automatically, as a result of the calculation of the other 14 digits.

Services Offered by Us

Following are the services provided by us at the time of registration.

- Timely Review and Response to Notice

- Compilation of Details

- Document submission

- Advisory on Compliance and Planning

- Representation to Authorities

- Dealing Faceless Assesments

Procedure of Registration?

Fill Enquiry

Form

Associate will call

and discuss in length.

Make

Payment

Complete Documentation

& Requirements

Registration

Complete

Why Palankarta?

Palankarta gives an end-to-end service for GST, return, documentation and filing. The solution to all your questions and concerns of GST.

Experienced Financial

Professionals

Deliver Service

on Time

Cost

Effective

Assured Customer

Satisfaction

No Hidden

Fees / Charges.