Private Limited Company

Indian legal structure offers various options for the Businesses to register themselves depending on their Business structure, Business Goals, & Mode of operations. Every Business structure is unique in its own way and has some distinctive features. In this piece of information, we will explain one of those structures, a Private Limited Company. It is the most popular Business structure for registered Businesses in India. More than 90% of companies in India are registered as Private Limited Company.

Businesses often chose a private company due to its flexibility and limited liability. We will be discussing all these features later. But first, let’s understand ‘WHAT IS A PRIVATE LIMITED COMPANY?’

A company established under section 2(20) of Companies act 2013, that by its articles of association:

- Restricts transferability of shares

- Limits the number of members, and

- Prohibits invitation to subscribe for its securities to the public is called a Private Limited Company

Types Of Private Limited Company

The Private Limited Company in India can be classified into the following three types:

- Company limited by shares: Here, a member’s liability is limited up to the unpaid amount of the shares held by him. This outstanding amount can be called up at any time either during the Company’s life or at the time of its liquidation.

- Company limited by guarantee: Here, a member’s liability is limited up to the guarantee provided by him. This amount can only be called at the time of liquidation.

- Unlimited liability company: Here, the members have unlimited liability. However, these type of Private companies exists in theory only.

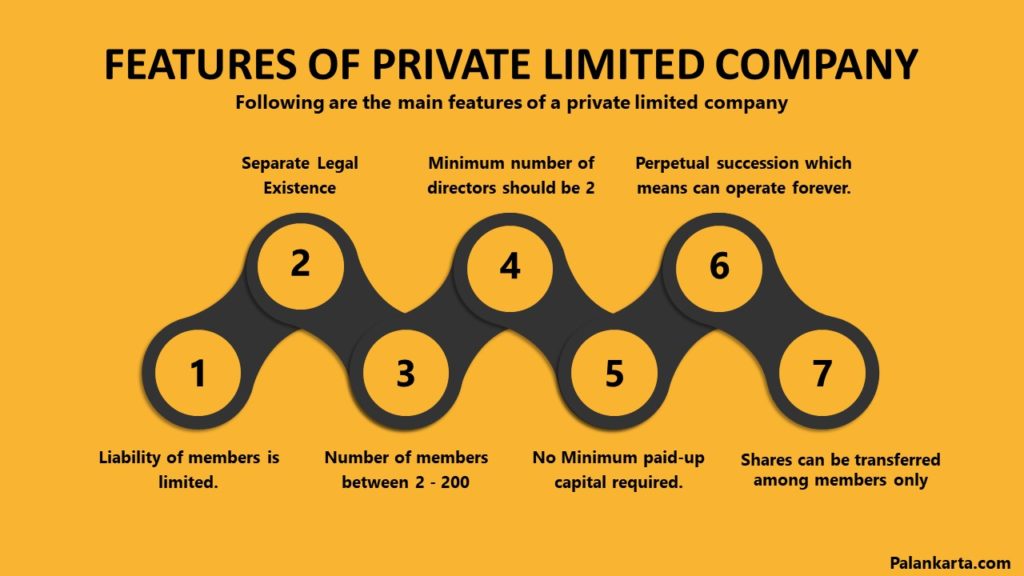

Features Of Private Limited Company

- Limited Liability: This is one of the primary reasons businesses opt for a Private Limited structure. This feature limits the liability of the members to the number of shares they hold. This means, in case of any financial crisis, the personal assets of the members cannot be used to pay off any outstanding amount of debts. But, their share in the said Company can be used to pay off the debts.

- Separate Legal existence: A Private Limited Company is treated as a separate legal entity in the eyes of the law. This means it can have its own assets, liabilities & debts. A Private Limited Company has the authority to buy and sell properties and conduct Business in its own name. It can do Business, & can buy and sell property in its own name. This is a stark contrast from a Sole Proprietorship, in which the firm and owner are treated as one.

- Perpetual Succession: Perpetual Succession means that a Private Limited Company can operate forever. A Private Limited Company is immune to the Death, Inability of its any member to discharge the duties or Insolvency of any member and may continue to operate as usual, until it is legally dissolved.

- Number of members: The law mandates that at least 2 members are required to establish a Private Limited Company. Also, there is a cap of 200 on the maximum number of members.

- Minimum Paid-up capital: Earlier there was a minimum paid-up capital requirement of ₹ 1 lakh to incorporate a company, but the amendment in the year 2015 removed it. As of today, there is no such requirement of minimum paid-up capital.

- Number of directors: A private company must have a minimum of 2 directors. The maximum number of directors a private company can have is 15. But if the Company wants to increase the number of directors beyond 15, it can do so by convening a General Meeting and passing a Special Resolution for which more than 75% majority is required

- Securities of a Private Limited Company: A private company can issue securities to promoters and their relatives, directors, relatives, and employees. However, it is not allowed to issue securities to the public at large.

- Transferability of Shares: The Company members can transfer the shares to other members but are not allowed to transfer the shares to a person who is not a member of such a Company.

- Small Company: A private company whose paid-up capital is not more than ₹ 50 lakhs and turnover as per profit and loss account of immediately preceding financial year do not exceed ₹ 2 crores is called a SMALL COMPANY under section 2(85).

- Penalty for less than 2 members: If at any time, during the life of the Company, the number of members is reduced below 2, the Company or its remaining members are required to appoint the new member/s within six months. Intentional failure to do so for more than six months while the number of members stays below 2 will attract penalties as per law

Privileges of Private Limited Company

- Member Index: It is not mandatory for a private company to maintain a register of the name of the members of the company. The Companies Act 1956 otherwise states that a company having more than 50 members shall have a register containing the name of the company members and their respective shares, maintained at all times.

- Prospectus: It is not mandatory for a Private Limited to issue prospectus to the Securities And Exchange Commission. The SEC issues a company prospectus containing details of the company’s operation and security offerings to the public.

- Eligibility For Different Schemes: Private Limited Company is eligible for multiple government schemes aiming at facilitating the growth of startups and private companies.

- Funding: It is relatively easy for a Private Limited Company to raise funds from investors and venture capital firms.

Conclusive Thoughts

A Private Limited Company enjoys multiple benefits from the Government. Private Limited Company is best suited for the Businesses that are planning to raise the capital from external sources or want to offer ESOPs to their employees. It is a perfect option for a business that is focusing on long-term growth in the market.

Like every Business structure, this one too has some benefits and limitations. Ultimately it is your Business goal that should drive the selection of the Business structure. But we would recommend consulting an expert to get an in-depth analysis of the matter for a better outcome. We also provide business registration consultation as well as private limited company registration at our Mumbai office.

Hope this blog has cleared a lot of your doubts about a Private Limited Company. In, case you need more information, we are here to help.

Which features of a Private Limited Company do you think is the most iconic?

Do let us know.

No comment